Navigating the world of billing software can be overwhelming, especially for small businesses and freelancers who want to focus on their core responsibilities. But what if there was a comprehensive guide to help you choose the best billing software for your needs, tailored to the unique challenges faced by small businesses and freelancers in 2023? Look no further! In this blog post, we’ll explore the top billing software solutions, discuss their key features, and provide tips on how to choose the right one for your business.

From recurring invoices and payment automation to project management and client communication, we’ll dive deep into the world of billing software, uncovering the benefits of free vs. paid options, and examining the importance of integrating billing software with accounting systems. So buckle up and get ready to streamline your invoicing process and boost your business’s efficiency!

Are you looking for the best billing software for small businesses with all types of pricing edge cases covered? Try Togai, your first $50k is totally free!

Top Billing Software Solutions

When it comes to invoicing software, there’s no one-size-fits-all solution. Small businesses and freelancers have diverse needs, and with a plethora of billing and invoicing software available, it can be challenging to find the perfect fit. Some of the top contenders in the market include:

Each of these platforms offers a unique set of features and benefits, from recurring invoices and time tracking to customizable invoice templates and expense tracking.

While each of these software solutions has its strengths, it’s important to consider your business’s specific needs when choosing the best invoicing software. Factors such as the number of clients, projects, and invoices you manage, your preferred payment methods, and your desired level of customization will all play a role in determining the best fit for your business.

With that in mind, let’s delve into some of the key features offered by top billing software solutions and how they can benefit your business.

Recurring Invoices and Payment Automation

One of the most time-consuming aspects of invoicing is managing recurring payments. Imagine if your software could automate this process for you, saving you valuable time and reducing the likelihood of errors. That’s where recurring invoices and payment automation come in. Many invoicing software solutions, such as Togai, Zoho Invoice, offer detailed workflows for actions like adding discounts for early payments, sending payment email reminders, and tracking expenses.

Square online invoicing software, for example, allows you to send unlimited invoices, supports recurring billing and automatic payment reminders, simplifying the invoicing process and ensuring payments are received on time. By automating these tasks, you can focus on more critical aspects of your business, knowing that your invoicing process is running smoothly and efficiently.

Time Tracking and Expense Management

Accurately billing clients and managing project costs are crucial aspects of any business, and business management software with built-in time tracking and expense management features can be a game-changer. QuickBooks. Online, for instance, is a cloud-based accounting software that provides features such as invoicing, time tracking, and expense management.

Another example is Togai, a comprehensive billing platform that offers billing and invoicing capabilities. By having these features integrated into your billing software, you can streamline your financial management processes, improve accuracy, and ensure that you’re billing clients for every minute of work and every expense incurred.

Customizable Invoice Templates and Branding

Maintaining a consistent and professional image is essential for any business, and having customizable invoice templates and branding options in your billing software can make a world of difference. With the ability to choose from a range of templates and personalize your invoices with logos and colors, you can create a cohesive and professional look for your business.

Wave’s invoicing software provides the following features:

- Intuitive navigation

- Selection of templates to customize the layout and design

- Ability to add logos, adjust colors, and add discounts and notes with the click of a button

By choosing billing software with customizable options, you can ensure that your invoices not only look professional, but also represent your brand and business accurately.

Integrating Billing Software with Accounting Systems

Efficient financial management and reporting are critical for any business, and integrating your billing software with accounting systems can streamline these processes. By connecting your invoicing solution with accounting software, you can ensure that your financial data is accurate, up-to-date, and easily accessible, all in one place.

To demonstrate the benefits of integrating billing software with accounting systems, let’s take a closer look at how Togai, Zoho Invoice can be connected with QuickBooks and how Xero can be integrated with FreshBooks.

Togai and Zohobooks/QuickBooks

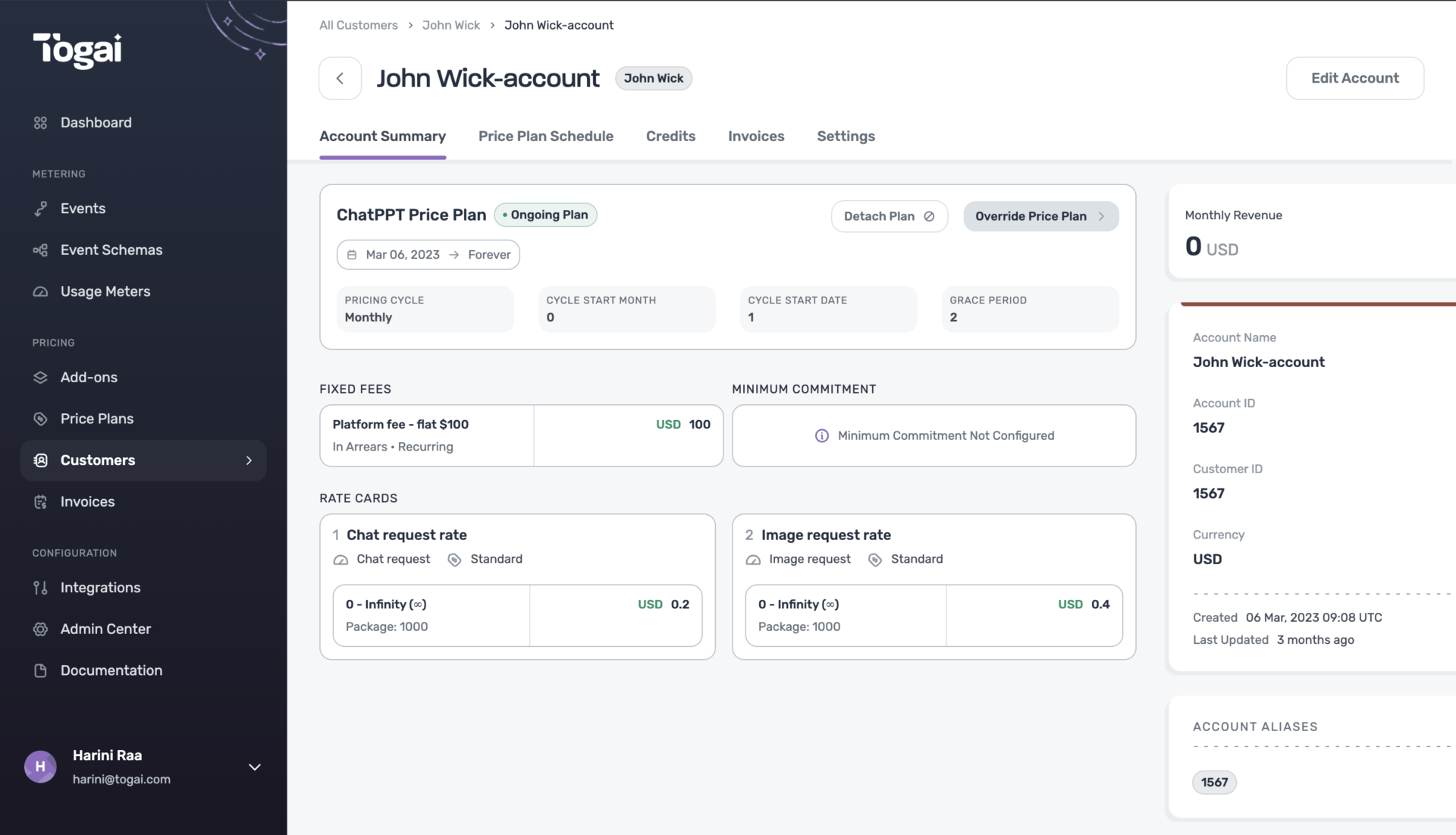

Togai is a SaaS billing software that can be used for different types of billing models such as usage, license, hybrid, and more! Togai has powerful native integrations built with Zoho Books and Quick Books that accounts for a two way sync. For instance, Any account created in Togai is directly reflected in your bookkeeping software and vice versa. Similarly Invoices created in Togai is directly synced to your Bookkeeping software and is accounted for similarly. Integrating Togai and your bookkeeping software provides benefits like streamlined billing and accounting procedures, time and cost savings, and better expense and payment tracking.

Togai also provides custom integrations on request and integrates with a plethora of payment gateways such as Stripe, PayStack and more. By connecting your billing software like Togai and Zoho Books or QuickBooks, you can improve your financial management and reporting capabilities, ultimately benefiting your business.

This integration is a prime example of how connecting billing and accounting software can elevate your financial management processes.

Zoho Invoice and QuickBooks

Zoho Invoice and QuickBooks are both popular billing software solutions used by businesses worldwide. By integrating these two platforms, you can automate various processes, such as importing invoices and managing financial reporting. For example, Zoho Invoice can be integrated with QuickBooks via Zapier, allowing users to automate the process of importing invoices from Paymo to QuickBooks Online.

This integration not only helps businesses save time and reduce the likelihood of errors, but also ensures that they can make the most of both applications’ features, such as detailed workflows and automatic payment reminders.

Xero and FreshBooks

Xero and FreshBooks are two leading billing and accounting software solutions that cater to the needs of small businesses and freelancers. Integrating these two platforms can provide numerous benefits.

Connecting Xero and FreshBooks is simple, and the integration can be tailored to your specific business requirements. By combining the capabilities of these two platforms, you can optimize productivity, enhance financial visibility, and improve the accuracy of your invoices and reports.

Online Payments and Security Features

As more and more businesses move their operations online, the importance of secure online payment options and data security features in billing software cannot be overstated. Ensuring that your clients can accept online payments easily and securely is critical to maintaining their trust and satisfaction during the billing process.

In this section, we’ll explore the significance of accepting multiple payment methods and ensuring data security and compliance.

Accepting Multiple Payment Methods

Offering multiple payment options simplifies the payment process for clients, allowing them to choose the method that is most convenient for them. This can help minimize the number of unpaid invoices, as clients are more likely to pay when they have a choice of payment methods. The most commonly accepted payment methods are:

- Credit cards

- Debit cards

- PayPal

- Bank transfers

Some billing software also supports alternative payment methods such as Apple Pay, Google Pay, and cryptocurrency.

To configure multiple payment methods in your billing software, simply follow these steps:

- Provide the necessary information for each payment method, such as the account number or API key.

- Save the settings.

- Test each payment method to ensure they are working correctly.

- Once all payment methods are set up and tested, you’ll be able to start accepting payments.

By making it easy and secure for clients to pay their invoices, you can improve your cash flow and client satisfaction.

Ensuring Data Security and Compliance

Data security is a top concern for businesses, and it’s crucial to choose billing software that prioritizes the protection of your financial information. When selecting your billing software, look for features such as:

- Encryption: ensures that your data can only be accessed by authorized users

- Data backup: provides an additional layer of protection in the event of data loss or a security breach

- Compliance with industry regulations: ensures that the software meets the necessary security standards

By considering these features, you can ensure that your financial information is well-protected.

Additionally, it’s important to consider any industry-specific regulations that your business must adhere to, such as HIPAA for healthcare businesses or GDPR for companies operating in the European Union. By choosing billing software that prioritizes security and compliance, you can safeguard your financial data and maintain the trust of your clients.

Project Management and Client Communication

Billing software that includes project management and client communication features can be a valuable asset for small businesses and freelancers. In this section, we’ll discuss the benefits of incorporating task and milestone tracking, as well as client portals and collaboration features, into your billing software.

Task and milestone tracking can help you stay organized and on top of your projects. You can.

Task and Milestone Tracking

Task and milestone tracking is an essential feature of billing software, as it helps businesses stay organized and on schedule. By keeping track of tasks and milestones associated with projects, businesses can ensure that they’re meeting deadlines and staying on target. Features such as task lists, project timelines, and progress tracking can assist businesses in managing their workload and prioritizing tasks effectively.

In addition to helping businesses stay organized, task and milestone tracking can also provide valuable insights into project progress and potential issues. By monitoring tasks and deadlines, businesses can identify potential problems before they escalate, ensuring that projects stay on track and clients remain satisfied.

Client Portals and Collaboration

Client portals and collaboration features are essential components of billing software, as they enable businesses and clients to communicate and collaborate more effectively. Providing a secure environment for exchanging documents and data, these features can help expedite billing processes and reduce the effort required to manage them.

In addition to facilitating communication, client portals and collaboration features can also foster transparency and trust between businesses and clients. By providing clients with access to project updates, invoices, and other important documents, businesses can keep clients informed and ensure that they remain satisfied with the level of service provided.

By incorporating these features into your billing software, you can enhance your client relationships and ensure smooth project management.

Free vs. Paid Billing Software Options

When selecting billing software, one of the key factors to consider is whether to opt for a free or paid solution. Both options have their benefits and limitations, and the choice will largely depend on your business’s specific needs and budget.

In this section, we’ll compare the advantages and disadvantages of free and paid billing software options to help you make an informed decision.

Benefits of Free Billing Software

Free billing software, such as free invoicing software, can be an attractive option for small businesses and freelancers looking to reduce costs and access essential invoicing features. By eliminating the need for expensive software licenses and associated maintenance expenses, free billing software can provide significant cost savings. In addition, free billing software typically offers fundamental invoicing capabilities such as invoice creation, payment tracking, and customer management.

Free billing software with unlimited invoices can still be an ideal solution for businesses with limited invoicing needs and tight budgets. Platforms like Togai ensures the first $50k is free which makes it ideal for small businesses.

When to Upgrade to Paid Billing Software

Upgrading to paid billing software can provide numerous advantages, such as increased customization options, access to advanced features, and improved scalability. When considering whether to upgrade, it’s important to assess your business’s needs and the features and customization options that would be most beneficial to your operations.

Paid billing software typically offers features like time tracking, expenses, and business branding, which can be vital for businesses with more complex invoicing requirements. Additionally, paid solutions offer scalability, allowing you to add or remove users, customize invoices, and manage multiple accounts with ease.

While the cost of upgrading to a paid billing software solution varies, the benefits often outweigh the expense, making it a worthwhile investment for many businesses.

Tips for Choosing the Right Billing Software

Selecting the right billing software for your small business or freelance needs can be a daunting task, but by considering the following tips, you can find the solution that best fits your requirements.

1. Assess your invoicing needs: Consider the number of clients, projects, and invoices you manage, as well as your preferred payment methods and desired level of customization.

2. Compare features: Evaluate different billing software solutions based on their features, such as recurring invoices, time tracking, expense management, and customizable invoice templates.

3. Consider integration with accounting systems: Ensure that your chosen billing software can be integrated with your existing accounting software for seamless financial management and reporting.

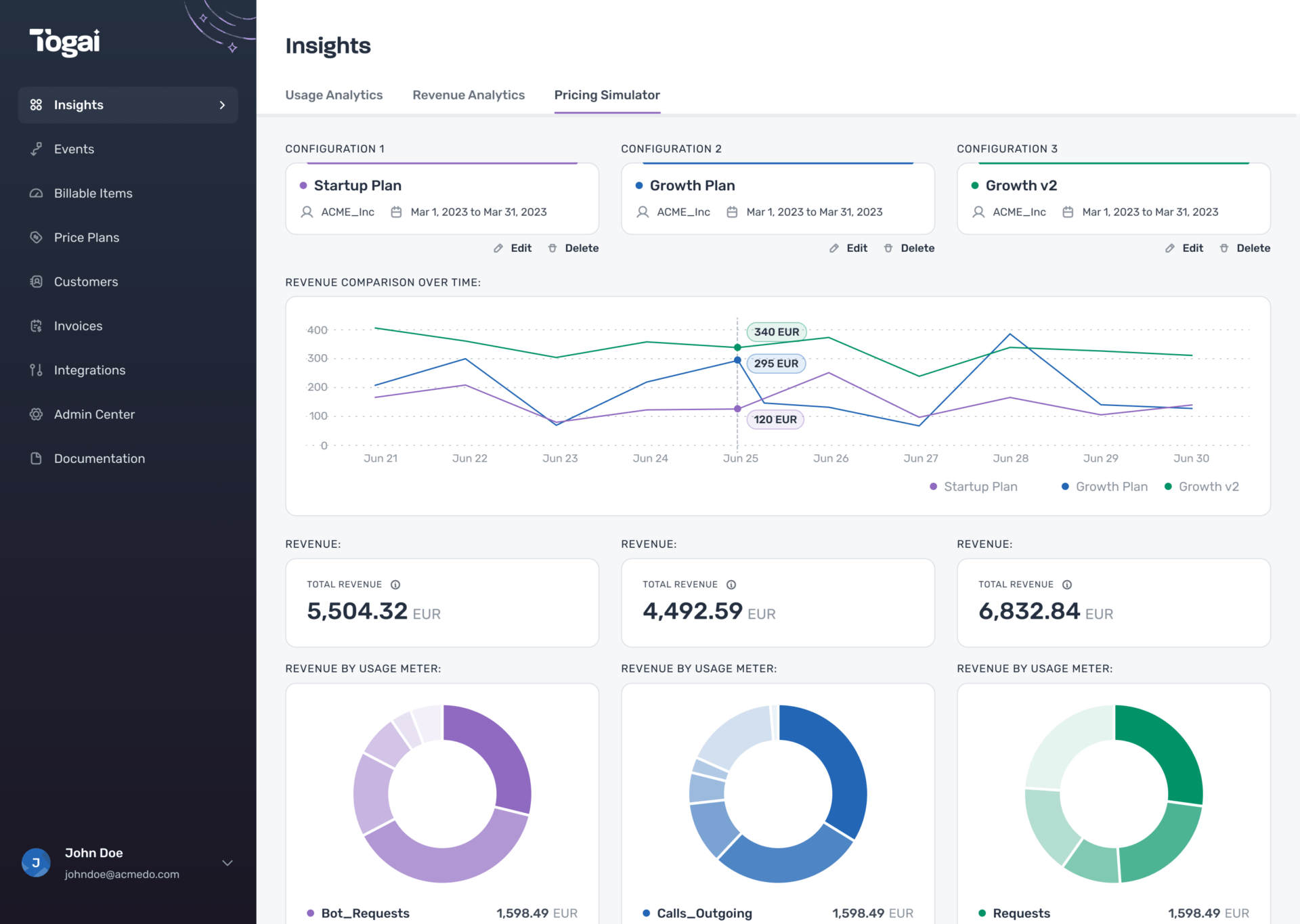

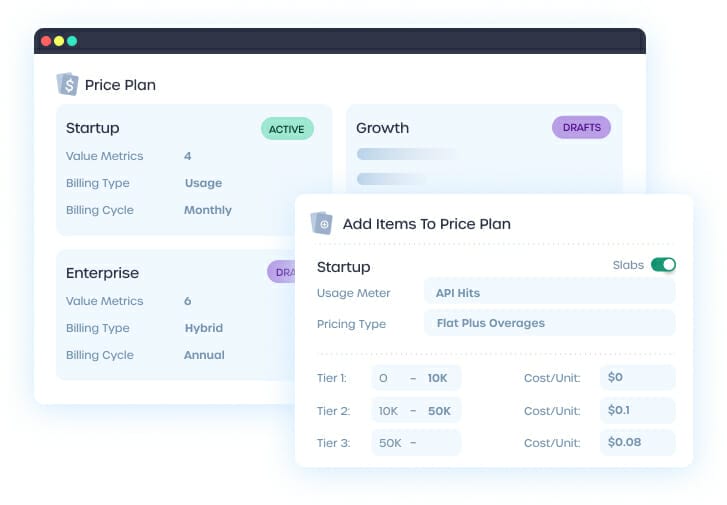

4. Ensure they provide different billing models: Your billing software should help you bill for usage, seat based, or hybrid billing models. It shouldn't be restrictive, and also provide you with unique scope for growth. For instance, on top of being able to customize your pricing models, Togai also enables you to provide support for PLG or startup/self-serve tiers using Entitlements.

With Togai's Entitlements you can provide credits, package your top-selling features, gate usage, set rate limits and effectively increase revenue. This will enable you to cater to different segments of the audience seamlessly on top of your existing operations.

5. Examine security features: Look for billing software that prioritizes data security and complies with industry regulations to protect your financial information.

6. Weigh the benefits of free vs. paid options: Assess the advantages and limitations of free and paid billing software to determine which option best suits your business’s needs and budget.

By taking these factors into account, you can make an informed decision and select the billing software that will best support your business’s growth and success.

Summary

In conclusion, choosing the right billing software for your small business or freelance needs is an essential step in streamlining your invoicing process and improving your financial management. By comparing the features and benefits of various billing software solutions, considering the integration with accounting systems, and weighing the advantages of free vs. paid options, you can find the perfect fit for your business.

Remember, the ideal billing software will not only save you time and effort, but also enhance your client relationships, improve your cash flow, and support your business’s growth and success. With the right billing software solution in place, you can focus on what truly matters: delivering exceptional products and services to your clients and growing your business.

Frequently Asked Questions

What is a billing software tool?

Billing software is an accounting application designed to automate and streamline invoice processing and payment services, helping businesses to charge consumers for products and services received.

What is the best program to create invoice?

QuickBooks invoicing software is the best program to create invoices due to its customizable branding, automation of the billing process and payment processing.

FreshBooks, Square, Invoice Ninja, Invoicing Simple and Zoho Invoice are some of the top invoicing software in 2023, with QuickBooks offering the most detailed reporting.

What are some examples of top billing software solutions for small businesses and freelancers?

For small businesses and freelancers, popular billing software solutions include FreshBooks, Zoho Invoice, Xero, and Wave.

What are some key features to look for in billing software?

When choosing billing software, it is important to look for features such as recurring invoices, time tracking, expense management, and customizable invoice templates.

These features can help streamline the billing process and make it easier to manage. Additionally, look for software that is easy to use and has good customer support. This will ensure that you have the help you need when you need it.

How does integrating billing software with accounting systems benefit my business?

Integrating billing software with accounting systems streamlines financial management and reporting, allowing for accurate, up-to-date, and easily accessible financial data - ultimately improving your business’s operations.

This improved financial data can help you make better decisions, reduce costs, and increase profits. It can also help you stay compliant with regulations and provide better customer service.

By integrating billing software with accounting systems, you can ensure that your financial data is accurate.