TL;DR

- Boost your sales cycle's efficiency by optimizing each stage of the quote to cash process, ensuring better revenue and customer trust.

- Adopt CPQ solutions to configure the ideal product mix and price accurately, while CLM solutions manage contract intricacies and negotiations.

- Embrace automation to not only streamline operations but also to enhance the overall customer experience and foster loyalty.

- Automate the Q2C process to minimize errors, expedite contract signing with eSignature solutions, and ensure accurate billing and revenue recognition.

- Enhance customer experience and retention by streamlining renewals and identifying upsell and cross-sell opportunities with an integrated Q2C approach.

- Address challenges like delayed payments and customer dissatisfaction by implementing efficient, automated quote-to-cash workflows.

- Choose the right Q2C tools, including CRM, CPQ, ERP, and pricing software, to drive sales and operational efficiency.

- Optimizing the Q2C process with the right tools, such as Togai, can significantly cut launch times and operational costs.

- Streamlining the Q2C process leads to improved sales systems, quicker sales cycles, and increased revenue opportunities.

Did you know that the efficiency of your quote-to-cash process can significantly impact your bottom line? The journey from a potential client's inquiry to the final payment - commonly referred to as the quote-to-cash or Q2C process - touches numerous stages of your sales cycle. From pricing and drafting quotes to contract handling, order execution, and billing, every step matters. Mistakes or delays at any stage can disrupt not only your revenue but also customer trust. So, what's the remedy? A streamlined Q2C process tailored for the SaaS sector. As you read on, you'll find actionable recommendations to enhance your process, ensuring better business results without the usual hiccups.

What is the Q2C Meaning?

The quote-to-cash process, often referred to as Q2C, is your business's roadmap from the time a potential customer expresses interest until the concluding transaction. Think of it as the spine of your sales cycle. It spans a wide array of activities, from offering configuration and pricing to generating quotes and contract management. This journey also includes tasks like fulfilling orders, invoicing clients, recognizing revenue, and spotting renewal opportunities.

🔆 Optimizing each component of this process can profoundly boost your operational efficiency and profitability.

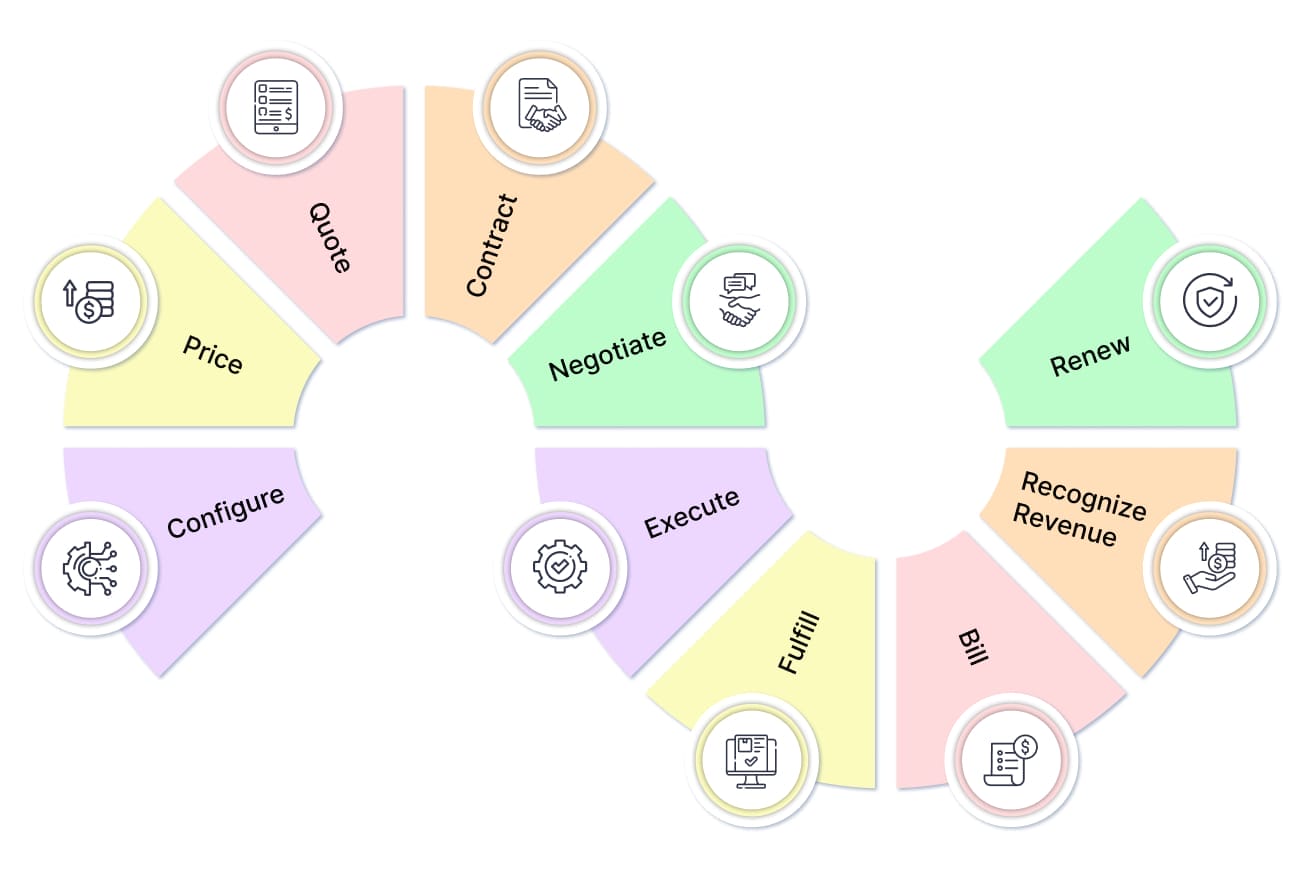

Quote-to-Cash Process

The QTC process can vary based on company structure and industry, but it typically involves a consistent sequence of 10 steps.

Configure

In the configuration stage, the primary objective is to pinpoint the optimal combination of services and products tailored to meet the unique needs of your customers.

In today's dynamic business landscape marked by increasing product and deal intricacies, it's crucial to recommend the right mix of services and goods to secure a deal. Utilizing a configure-price-quote (CPQ) solution streamlines this process, enabling your sales representatives to receive automatic recommendations and evolve into configuration experts.

Price

In QTC, pricing revolves around the rules that guide sales professionals in determining the most effective pricing strategy for a deal. Identifying the right price for your products is only half the equation. Equally vital is the application of the correct set of promotions, incentives, and discounts to win customers—without compromising margins.

A CPQ solution plays a pivotal role in revealing successful promotion and pricing strategies from the past. This allows sales representatives to apply proven strategies to future deals, resulting in an increased deal size and a higher win rate.

Quote

Quotes represent a critical juncture in the sales cycle, often serving as a customer's initial impression of your business. Delivering an accurate and prompt quote enhances your chances of winning a deal, while a sluggish quote riddled with errors could potentially cost you a customer.

During the quoting phase of the QTC process, a CPQ solution empowers your teams to craft error-free and on-brand quotes that not only meet but exceed customer expectations, contributing to a positive customer experience.

Contract

Create a secure contract that captures the intricate details of the deal. Every deal necessitates a comprehensive agreement outlining the agreed-upon conditions and terms. However, manually generating business agreements poses considerable risks and can significantly impact revenue streams. Safeguarding your business requires meticulous attention to detail, making a document generation solution indispensable for ensuring the safety and efficiency of the QTC process.

Additionally, as contracts take shape, it is crucial that the relevant stakeholders have visibility into contract terms, including termination and renewal clauses, and the real-time status of the contract. This not only mitigates risks but also streamlines the approval process.

Negotiate

During the contract negotiation phase, effectively managing redlines from all parties involved and implementing strict version control is paramount. However, achieving this level of control is challenging without a contract lifecycle management (CLM) solution.

As contract negotiations commence, having granular visibility into changes in each iteration of the contract becomes critical. A CLM solution can automatically furnish this information to your legal team, significantly reducing manual tasks that consume valuable time.

Execute

During the contract execution stage, the necessary approvals for the final contract are obtained. In an era where an increasing amount of business is conducted virtually, capturing signatures can pose a substantial hurdle in the sales cycle, potentially slowing down the time to revenue.

Integrating an eSignature solution proves instrumental in significantly reducing the time spent acquiring signatures to finalize contracts. A robust eSignature tool offers visibility into the delivery and viewing status of contracts, as well as identifies parties that are yet to sign, enabling targeted and timely follow-ups.

Fulfill

Upon the completion of the signed contract, operations kick into high gear to ensure the prompt and accurate delivery of products. An automated and integrated system provides a comprehensive view of the customer's journey, ensuring that any modifications to the order are accurately reflected in the final product delivery. An end-to-end QTC solution plays a crucial role in communicating the agreed-upon quotes, pricing, and contracting terms to the relevant parties.

Bill

In the billing phase of the QTC process, charges are meticulously calculated, and invoices are promptly dispatched to the customer to facilitate on-time payment. Accurate billing stands as a linchpin for your company's success, influencing the creation of reliable sales forecasts and accurate cash flow management.

Seamless integration within the QTC process simplifies billing, as all details captured in the quote—such as billing timeframes and discounts—and the contract are automatically transmitted to your accounting team.

Recognize Revenue

The revenue recognition stage marks the receipt of payment from the company, officially recording the revenue to maintain an accurate view of profit and loss. Recognizing revenue incorrectly poses significant risks. When crucial contract details, such as net payment terms, delivery schedules, and pricing, are automatically shared with the accounting department, your company is better positioned to recognize revenue accurately.

Also Read: Exploring Methods and the Process Model of Revenue Recognition in SaaS

Renew

Concluding the QTC process is the management of recurring revenue and customer retention. In numerous business models, a substantial portion of revenue is derived from subscription and repeat customers, underscoring the importance of identifying customer renewals. An automated and integrated QTC process provides profound insights into contracts, renewal data, and quotes. This enables your business to optimize cross-sell and upsell opportunities, diminish churn, and pinpoint expiring contracts.

6 Common Challenges in Quote-to-cash Process

Businesses often grapple with the task of optimizing their quote-to-cash process, encountering a host of challenges that impact their bottom line. Missed opportunities, payment delays, and subpar customer experiences are among the consequences of these struggles. Here are some of the most prevalent challenges faced by businesses in this regard.

1. Ineffective Quote Creation

Not every quote transforms into a successful purchase, often due to ineffective pricing strategies. When the sales team struggles to generate an error-free or competitive quote, it results in lost business prospects. Leveraging automated processes and implementing the right pricing strategy empowers the sales team to craft competitive and well-thought-out quotes.

2. Error-Prone Invoicing

If the accounts department adopts a methodology of comprehensively understanding each sale before initiating the billing process, it can lead to payment delays. Delayed payments, in turn, impact the organization's cash flow. In cases where invoices contain inaccuracies, customers return them, prompting the sales team to investigate and rectify the issues.

3. Inaccurate Revenue Recognition

Manually handling all revenue recognition activities can be a laborious task prone to errors. Incorrect profit or loss declarations may result, leading to inaccurate revenue projections for the business.

4. Payment Delays

In a non-streamlined and integrated quote-to-cash process, the likelihood of errors is heightened. Customers return inaccurate or overpriced invoices for corrections, requiring the sales team to invest time in rectifying these errors. Simultaneously, the accounting department must meticulously review each invoice, comparing it with available records to identify and rectify errors.

5. Customer Dissatisfaction

Maintaining robust customer relationships is paramount for differentiating a business from its competitors. Relying solely on manual processes increases the chances of delays and errors, ultimately leaving customers dissatisfied. Customer discontent not only affects current relationships but also casts a negative shadow on potential prospects.

6. Missed Opportunities

In businesses where the customer experience is compromised, and sales cycles are prolonged, the likelihood of missing cross-sell and upsell opportunities significantly rises. This not only impacts the business's bottom line but also hampers cash flow, which is essential for sustaining and growing the business.

Benefits of a Streamlined Q2C Process

Streamlining the quote-to-cash process brings forth numerous advantages for any business, contributing to overcoming challenges and enhancing overall efficiency. These benefits translate into a more seamless work experience for employees. Here are some of the key advantages:

Improved Sales Systems

Automation of quote-to-cash processes eliminates silos between different departments, fostering improved communication and overall operational efficiency. The streamlined process also reduces the sales cycle, leading to increased revenue through a more enhanced customer experience.

Identification of Sales Opportunities

Data availability enables sales representatives to create more detailed quotes, facilitating the identification of opportunities for upselling and cross-selling. This enhances the sales team's ability to capitalize on potential avenues for revenue growth.

Minimization of Quoting Errors

The automation of quote-to-cash processes significantly reduces human errors, providing a higher likelihood of converting prospects into paying customers. This not only avoids potential embarrassments and revisions but also contributes to a smoother sales process.

Reduction of Order and Invoicing Errors

Automation diminishes errors in order and invoicing by eliminating the need for manual data input. Real-time data sharing between departments ensures that one department's actions trigger the subsequent steps. For instance, the fulfillment of an order automatically initiates the preparation and sending of an invoice by the accounts receivable department.

Increase in Customer Retention

Enhancing the customer experience is paramount for improving customer retention. Streamlining and automating business processes, including the quote-to-cash journey, contribute to a more accurate and efficient customer experience. This involves reducing the sales cycle and ensuring precise and timely communications.

Boost of Revenue

Streamlining and integrating processes enable businesses to identify and capitalize on cross-sell and upsell opportunities early in the customer journey. Successfully securing customers translates to a significant revenue boost with minimal effort and cost, showcasing the financial benefits of an optimized quote-to-cash process.

| Key Focus Area | Benefit |

|---|---|

| Sales System Efficiency | Unearth more sales opportunities, reduce quoting errors |

| Sales Cycle Speed | Faster deal closures, increased revenue potential |

| Customer Experience | Foster loyalty; promote repeat business |

| Resource Management | Reduced costs, improved revenue prediction from services |

| Automation in Q2C Process | Elevate overall process efficiency |

Improving Quote-to-cash With Automation

While integral to many business sales processes, Q2C processing can prove time-consuming and intricate. Fortunately, various software solutions are available to simplify quote-to-cash processing, enabling businesses to efficiently manage customer orders with minimal hassle.

When exploring quote-to-cash software solutions, key features to consider include the ability to automate both delivery and quote creation, scalability to accommodate business growth, and seamless integration with existing billing systems and sales. Additionally, beneficial features may encompass tools for managing customer quote approval workflows, tracking and reporting quote-to-cash progress across different teams or regions, and analyzing quote conversion metrics over time.

With a plethora of quote-to-cash solutions in the market, conducting thorough research is essential to select the one that aligns best with your business needs.

The Benefits of Automating the Quote to Cash (Q2C) Process

Enhancing Sales Systems

The primary goal of automating any business workflow is to enhance its overall performance. With the automation of the quote-to-cash process, redundant steps are eliminated, resulting in a streamlined workflow that achieves high productivity levels. Automation eradicates silos between different departments, fostering improved business operations and seamless communication. Moreover, sales automation contributes to a shortened sales cycle, leading to enhanced customer experience and increased revenue.

Detecting Sales Opportunities

An automated sales process provides real-time data to the team, empowering sales representatives to create accurate and more detailed quotes. Equipped with the right data, sales reps can identify potential opportunities for upselling and cross-selling, thereby maximizing revenue potential.

Reducing Quoting Errors

Human-driven processes are inherently susceptible to miscalculations and errors. The automation of the quote-to-cash process removes human involvement in data-intensive tasks, significantly reducing error margins. This reduction in errors enhances the chances of converting prospects into paying customers, while the need for repeated revisions and reviews is considerably minimized through automation.

Reducing Invoicing and Order Errors

Minimizing human involvement in data-intensive tasks like invoice and order processing automatically eliminates data-related errors. Automating invoice and quote preparation reduces errors in these processes to nil. Additionally, departments can seamlessly share real-time data, with actions in one department triggering automatic actions in others within the automated quote-to-cash process.

Enhancing Customer Retention and Engagement

Ensuring a positive customer experience is paramount for any organization. The most effective way to achieve this is by automating labor and data-intensive internal processes to deliver better outcomes. Automation accelerates the sales process, shortening the sales cycle to the delight of customers. Automated processes facilitate timely communications and collaboration between team members and external stakeholders, ultimately enhancing the overall customer experience.

Improving Revenue

Streamlining and integrating the sales process through workflow automation tools enables sales personnel to capitalize on upsell and cross-sell opportunities early in the customer journey. Successful customer acquisitions translate to a revenue boost for the organization with minimal effort and costs.

| Key Focus Area | Benefits |

|---|---|

| Enhancing Sales Systems | Elimination of redundant steps, streamlined workflow, improved productivity levels, eradication of silos, enhanced business operations, shortened sales cycle, improved customer experience, and increased revenue. |

| Detecting Sales Opportunities | Real-time data empowerment, accurate and detailed quotes, identification of upselling and cross-selling opportunities, maximizing revenue potential. |

| Reducing Quoting Errors | Minimization of human involvement, a significant reduction in error margins, increased conversion of prospects to paying customers, and minimized revisions and reviews. |

| Reducing Invoicing and Order Errors | Elimination of data-related errors, nil errors in invoice and quote preparation, and seamless real-time data sharing. |

| Enhancing Customer Retention and Engagement | Focus on positive customer experience, accelerate the sales process, shorten the sales cycle, delight customers, facilitate timely communications and collaboration, and enhance the overall customer experience. |

| Improving Revenue | Streamlining and integrating sales process, early capitalization on upsell and cross-sell opportunities, successful customer acquisitions, and revenue boost with minimal effort and costs. |

Improve Your Quote-to-cash Process With the Right Tools

In achieving a streamlined and efficient quote-to-cash process, the incorporation of the right software is paramount. To maximize sales success and operational efficiency, consider implementing the following software solutions:

CRM Software

Customer Relationship Management (CRM) software plays a pivotal role in managing customer information and past sales data. Its utility becomes particularly evident during billing and contract signing, contributing to a comprehensive approach to customer interactions.

CPQ Software

Configure, Price, Quote (CPQ) software revolutionizes the process of creating custom-designed products. Traditionally, this involved extensive back-and-forth between departments. With CPQ software, manual operations are eliminated as the entire process, from entering product specifications to pricing and quoting, is seamlessly automated.

ERP Software

Enterprise Resource Planning (ERP) software is indispensable for effective inventory management. Internal inventory management is critical to ensuring an uninterrupted quote-to-cash process. ERP aids in tracking available materials and managing sourcing requirements, especially when generating Bills of Materials (BOM).

Pricing Software

A well-defined pricing strategy is essential for business growth. Conventional pricing techniques may fall short in today's dynamic business landscape, making pricing software driven by data a necessity. This ensures optimal growth for the business at the least cost, aligning pricing strategies with contemporary business demands.

Revenue Recognition Software

Opting for the best revenue recognition software is crucial for accurate revenue acknowledgment, regardless of the revenue type. Manual processes in revenue recognition are time-consuming and prone to human errors, making automated solutions indispensable for efficiency and precision.

Best Practices for Optimizing Quote-to-cash Process

Optimizing your quote-to-cash (QTC) process in the tech world can propel your business forward. This vital process spans from configuration, pricing, and quoting to contract drafting, negotiation, order completion, and billing. It plays a crucial role in converting potential clients into loyal customers and securing payments - a key success marker for your enterprise.

Here are some actionable steps to strengthen your QTC process:

Strengthen your quoting process: Equip your sales team with rich data to craft detailed quotes. This will not only boost sales but also enhance customer interaction by identifying upselling and cross-selling opportunities.

Focus on contracts: Draft precise terms and conditions to bring clarity to business deals and prevent future disputes. Plus, having a defined approval process ensures every contract, quote, and invoice is vetted and approved by the right stakeholders.

Service integration: As and when needed, weave new services into the contract and invoice timeline. This offers uniform billing, simplifying it for your customers.

Adhering to these practices helps eliminate QTC process glitches, cutting down costs and amplifying customer satisfaction. Always remember, the true measure of your QTC process's prowess lies in its capacity to turn leads into customers and ensure payment. Keep an eye on this metric and fine-tune your strategy accordingly.

Summary of Best Practices

| Action Point | Description | Outcome |

|---|---|---|

| Quote optimization | Equip sales team with data | Enhanced sales & customer experience |

| Contract clarity | Draft clear terms & conditions | Transparent transactions & fewer disputes |

| Approval process | Defined vetting mechanism | Accurate & reliable documents |

| Service Integration | Add services to contracts & invoices | Consistent billing |

Your Next Steps Towards Efficiency

Optimizing the quote-to-cash process boosts sales, cuts errors, and ramps up customer satisfaction. Embracing automation magnifies efficiency, echoing Bill Gates: "Automation applied to an efficient operation will magnify the efficiency."

The right software can transform your quote-to-cash journey. Togai, a metering and billing software, can enhance your quote-to-cash (Q2C) process, making it seamless and highly profitable. Leveraging the capabilities of a cloud metering system such as Togai could be precisely what your Q2C process requires.

So, are you ready to boost your business's potential? Explore Togai's sandbox, schedule a demo, or sample Togai for free. Realize how swiftly and effectively it shapes your pricing strategy. Here's to soaring higher in the SaaS industry!