TL;DR

- Understand what is recurring billing: a system where you're billed automatically for subscriptions, like a magazine, but for various services.

- Annual vs. Monthly billing options offer different advantages, and integrating both can cater to varied customer preferences.

- Learn how recurring billing works, from sign-up to automatic charges, and the types of businesses that benefit from it, such as SaaS and subscription boxes.

- Find out the differences between fixed and variable recurring billing and how they affect your payments, depending on your service usage.

- See why recurring billing is a boon for predictable revenue and customer convenience, but also note the potential for payment issues and service disruptions.

- Compare the merits of building your own billing system versus using established software, with a focus on compliance, maintenance, and scalability.

- Review the leading recurring billing software solutions that can help you manage your billing needs more effectively.

Convenience is no longer a luxury in today's fast-paced digital world; it is a necessity. As companies embrace technology to better serve their consumers, one feature stands out as a critical component of the digital transformation: recurring billing.

Understanding the subtleties of recurring billing can be beneficial whether you're a tiny business owner, a seasoned entrepreneur, or an inquisitive consumer.

In this blog we'll delve into the realm of recurring billing, dissecting its significance, benefits, obstacles, and successful management solutions.

What Is Recurring Billing?

Recurring billing, also known as subscription billing, is a payment model where customers are automatically charged at regular intervals (e.g., monthly or annually) for products or services they've subscribed to.

In simpler words, Customers are charged on a recurring basis for a product or service for which they have signed up. Consider it similar to a magazine subscription. Instead of paying each time a new issue is released, you pay once and the magazine arrives every month.

Similarly, with recurring billing, users provide their payment information once and are charged on a regular basis without having to do anything else.

How Does Recurring Billing Work?

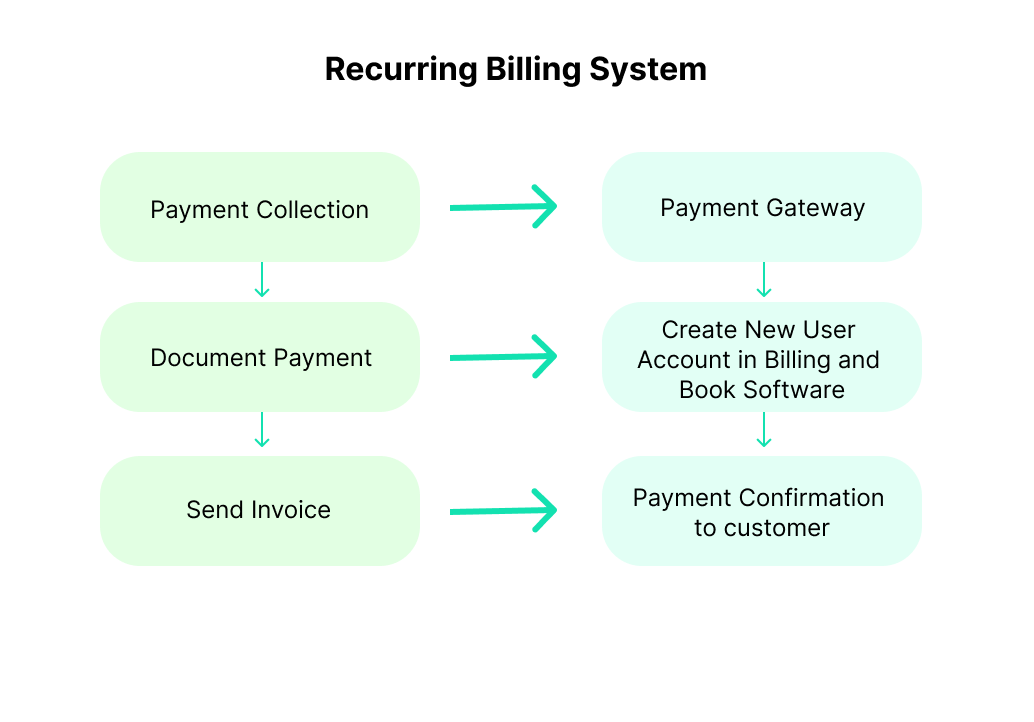

Let’s break down how a recurring billing system works into bite-sized steps:

Sign-up and Agreement: It all begins when a consumer selects a service or product that has a recurring charge.

Payment Information: The customer enters their preferred mode of payment. This could be credit card information, bank account information, or information about other payment methods such as digital wallets.

Setting up the Billing Cycle: The billing cycle is determined by the service. Weekly, monthly, and annual cycles are common. There may be options for some services, such as monthly or yearly billing.

Automatic Charges: The company's billing system automatically charges the customer's account on the specified date. This automation eliminates the need for the customer to remember to pay, resulting in uninterrupted service.

Notification and Transparency: Companies should tell clients before and after a charge. A pre-bill notice alerts them to an impending charge, while a post-bill notification confirms the amount charged. This keeps things clear.

Handling Payment Failures: Payments may fail to go through due to expired cards, insufficient cash, or other difficulties. When this occurs, most businesses will retry charging the account several times. If they are unable to complete the transaction, they will contact the consumer to amend or provide new payment details. During this time, some businesses may suspend service until the payment issue is rectified.

Cancellation and Refunds: For convenience, many services allow clients to cancel their recurring payments or subscriptions.

What Type Of Businesses Need Recurring Billing?

Recurring billing is the process of charging customers on a periodic basis (daily, monthly, annually, etc.) without requiring manual intervention every time a charge is due. This kind of billing system is useful for various types of businesses. Here's a list of some of them:

Subscription Box Services: These are companies that send subscribers a box of goods on a regular basis. Examples include beauty boxes, snack boxes, or monthly book clubs.

Software as a Service (SaaS): Many software platforms operate on a subscription model, where users pay monthly or annually to continue using the service.

Membership Websites: Websites that charge for premium content, community access, or other exclusive online services.

Telecommunications: Cable, internet, and phone service providers typically have monthly billing cycles.

Cloud Storage and Hosting Services: These services often offer monthly or yearly plans.

Online Courses and Learning Platforms: Some educational platforms offer content on a subscription basis.

Types Of Recurring Billing

Fixed Recurring Billing

In the fixed recurring billing model, customers are consistently charged the same amount every billing cycle. Businesses that offer services at a standardized rate often adopt this method.

A prime example is a gym membership, where members are charged a consistent fee monthly or annually. Similarly, when you subscribe to periodicals like The New York Times, you're typically charged using the fixed recurring billing model.

From a business perspective, this approach ensures a steady revenue stream.

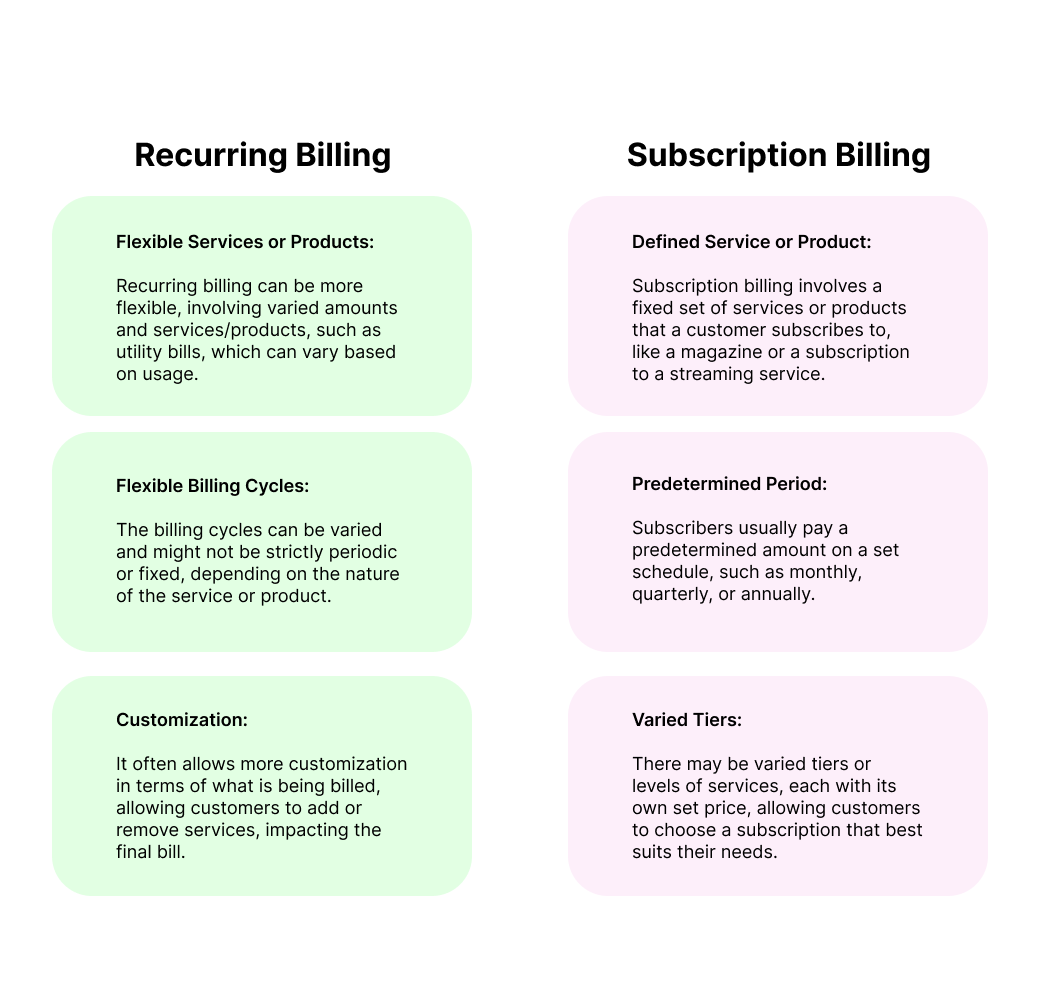

While the terms "subscription billing" and "recurring billing" tend to be used synonymously, there are subtle differences. Both models hinge on automated payment systems, retain customer payment details, and make regular deductions from customer accounts.

However, their distinction lies in their pricing structures. Subscription-based models may have varied pricing tiers, but recurring billing doesn’t necessarily mandate multiple pricing levels. The mechanism of billing remains consistent.

Variable Recurring Billing

Under the variable recurring billing framework, the charged amount might fluctuate each billing cycle, depending on the customer's engagement or consumption of the product or service.

A subtype of this model is usage-based billing. In this scenario, charges are levied on customers depending on how frequently they use a particular service. A quintessential example is utility bills, where consumers are charged based on their consumption.

Another variant is quantity-based billing. Here, the billing amount is determined by a predetermined quantity that the customer agrees to upon purchase.

Cloud storage services that charge based on the volume of storage used exemplify this billing type.

Is Monthly Recurring Billing Better Than Annual?

Annual subscriptions can:

- Increase your income

- Reduce the need for monthly invoicing

- Help you save money

On the other hand, Monthly subscriptions offer

- Offer flexibility

- Minimal risk

- Providing users with an accessible starting point

Many firms choose annual subscriptions because they increase cash flow and allow for the offer of special discounts or proportional refunds to develop long-term client commitments.

In summary, implementing a strategy that integrates both subscription alternatives is frequently the most logical approach, allowing clients to choose the plan that best meets their needs and interests.

How Does Recurring Billing Work For Different Pricing Models

Various SaaS pricing tactics can be implemented depending on your business structure. Recurring billing commonly integrates with the following pricing models:

Consumption/Usage-Based Billing:

In this approach, customers incur charges corresponding to their consumption of a product or service. Bills are generated after consumption on a predetermined schedule.

Want to know more about usage-based billing? Read more here.

Per-User Billing:

For SaaS solutions often utilized by extensive teams, a per-user billing strategy may be applied. Here, customers are recurrently billed according to the number of ‘seats’ or users they have registered under their account.

Tiered Billing:

This model involves different pricing levels corresponding to varying bundles of products or services.

Should customers opt for a different set of features or surpass a certain usage limit, they are required to shift to a more expensive pricing tier.

Regardless of the pricing model you implement, a recurring billing management system should be capable of seamlessly integrating with it, thereby streamlining the billing process and alleviating associated complexities.

Subscription Vs Recurring Billing - What Is The Difference?

Comparison:

While subscription billing involves paying a fixed amount regularly to access a specific set or level of services/products, recurring billing may involve variable amounts and more customizable services/products with flexible billing cycles.

Example:

Subscription Billing:

A customer subscribes to a music streaming service and chooses a premium plan. They are charged a fixed amount monthly to access ad-free music and additional features.

Recurring Billing:

A customer uses a cloud storage service where they pay based on the amount of storage they use each month. The amount billed each month can vary depending on usage.

For a deeper understanding of the contrast between subscription billing and recurring billing, delve into our blog post: “Subscription Billing Vs. Recurring Billing: What’s the Better Choice?”.

Advantages of Recurring Billing

Predictable cash flow

Recurring billing generates regular and consistent revenue at timed intervals. It ensures prompt customer payment and uninhibited cash flow, which is vital in cushioning any unforeseen market fluctuations. The cash flow predictability allows businesses to scale quickly and gain a higher ROI and capital allocation.

Convenient for buyers and sellers

With recurring billing, customers enjoy the convenience of simple signing up and payment methods. There is no need for repetitive signing up and updating of payment details. This one-time “set it and forget it” modality ensures the bill is automatically paid every month or year.

For businesses, the same convenience lowers the risk of delayed or denied payments, negating the need to follow up with customers.

Convenience of automation

Using the right billing software for recurring billing automates the entire process- From invoice creation and payment cycle setting up to linking customers’ payment details to billing the customer and charging for the services. There is no need for manual intervention or worry about errors and inaccuracies.

Customer retention

Some services require customers to agree to recurring payments to sign up. This customer retention effort requires customers to agree to periodic charges for services. To stop the service, customers must cancel it themselves. If not, the billing continues indefinitely.

Better customer satisfaction

Customers on recurring billing have a more positive experience for several reasons:

- They are not hounded repeatedly for payments.

- Longer payment commitments save them time.

- Discounts and promos help save money.

- Customized subscription boxes provide a personalized customer experience.

What are the challenges in recurring billing?

Problems in handling payment errors

Notifying customers about payment errors is a hassle, especially if your customer base is expanding. In some cases, the customer may be automatically charged the incorrect amount, resulting in delays in obtaining a refund. To avoid such pitfalls, it is safe to implement recurring billing for similar payments on a predictable schedule. Also, investing in good recurring billing software will prevent such confusion. The system can allow authorized customers to update their payment information in a self-service portal before processing their subsequent payment. This will save you time and effort.

Payment management hassles

Recurring billing is an ongoing payment method that can be more challenging than one-time sales. The challenge is additional when it comes to:

- Keeping track of customers on various billing cycles

- Cross-checking the different amounts

- Handling the various contract durations.

However, an integrated subscription management tool helps establish payment accuracy for the right amount and duration.

Halted services

When billing your customers regularly, they need to link their account to a savings checking account with a high balance. If not, a declined charge may result in an interruption to the customer’s service. This not only causes inconvenience but also dents the customer experience.

Want to know how to overcome recurring billing challenges? Click here to read our blog "Conquering Recurring Billing Issues: Practical Solutions for SaaS Businesses."

Do You Need To Build A Recurring Billing System?

Building a recurring billing system is a substantial undertaking that can be resource-intensive. Here are a few reasons why you should think twice before deciding to build your own recurring billing tool.

1. High Development Cost:

Creating a billing system in-house can be expensive. The development requires a significant investment in skilled personnel, technology, and time. The high upfront cost could outweigh the benefits, especially for small and medium-sized enterprises.

2. Complexity and Regulation Compliance:

Billing systems need to comply with various financial regulations, including tax laws and data protection legislation, like GDPR and PCI DSS. Ensuring compliance requires expertise and continuous updates to adapt to changing regulatory landscapes, adding layers of complexity and ongoing costs.

3. Maintenance and Updates:

Maintaining a billing system is resource-intensive. It requires regular updates, bug fixes, and upgrades to ensure optimal performance and security. This maintenance demands ongoing investment and can divert resources from core business activities.

4. Resource Allocation:

Building a billing system requires allocating substantial internal resources, including development teams, which could be better utilized in focusing on core business functionalities, innovations, and enhancements.

5. Scalability Concerns:

As your business grows, so will the demands on your billing system. A self-built system may struggle to scale with the evolving needs of the business, requiring additional investment and modifications.

6. Risk Management:

Errors in billing systems can lead to revenue loss, customer dissatisfaction, and reputational damage. Managing these risks is crucial and can be challenging, especially without specialized knowledge and experience in developing billing systems.

7. Time to Market:

Developing an in-house solution can be time-consuming. This elongated development cycle can delay the launch of new products or services, potentially affecting the competitive edge of the business.

Given these considerations, many businesses opt to leverage established third-party billing solutions. These platforms often offer comprehensive features, compliance management, scalability, and support, allowing businesses to focus on their core operations, reduce risks, and optimize time-to-market.

By choosing a reliable external solution, companies can avoid the pitfalls and challenges inherent in building and maintaining a proprietary recurring billing system.

Top Recurring Billing Software For Your Billing Purposes

In the current business environments, organizational billing needs are so diverse that they necessitate a range of recurring billing software. Fortunately, the market is chockablock with billing software to address the varying requirements of all kinds of business. Each solution has its unique set of features and benefits. Here’s a list of the top most-wanted billing software:

- Togai

- Recurly

- Chargebee

- Stripe

- Zuora

For a comprehensive analysis, explore our blog titled "Analyzing 2024's Top Choices for Recurring Billing Software: A Detailed Review".

Revolutionize Your Billing with Togai: The Simplest Way to Handle Recurring Payments

One of the biggest challenges B2B businesses face in this business environment is maintaining effective pricing with recurring billing. When selecting software for recurring billing, it is essential to review the various options available. Each one has its own features, benefits, and capabilities.

Togai, the best Usage-based billing software, stands out of the list for its ability to help businesses redefine their pricing models and billing strategies. Togai offers:

- Event-based structure

- Instant pricing alterations

- Integrated functionality

These features are only the tip of the iceberg. Schedule a free demo with us to witness the amazing capabilities of Togai. Seeing is believing! Contact us today!