TL;DR

- Understanding Stripe Billing Pricing is crucial as it varies with transaction volume and additional features used.

- Stripe offers a user-friendly platform with a suite of integrated products, but it may not be the best fit for every business model.

- Additional costs can accrue from Stripe's Scale plan, international transactions, and other integrated products.

- Hidden costs and difficulty in negotiating fees can surprise you, making it essential to scrutinize the fine print.

- Stripe's limitations for B2B businesses and its closed ecosystem can restrict operational flexibility.

- Negotiating with Stripe can be complex and may lead to multi-year commitments, affecting business flexibility.

- Assess your current and future billing needs to choose the right solution, whether it's Stripe or an alternative like Togai.

- For SaaS businesses, Togai presents itself as a tailored solution that could streamline billing and reduce costs.

Stripe is renowned worldwide as the fastest-growing payment platform, well-received among small and medium businesses. Stripe has many striking features - a user-friendly intuitive interface, a vast developer community, exhaustive API documentation, and super easy integration, to name a few. Over the years, Stripe has risen as the go-to product for managing recurring payments and subscriptions.

So, it is no surprise that thousands of businesses are itching to start with Stripe. After all, who doesn’t get excited about speed and simplicity?

But here’s the deal. Search for reviews on Stripe pricing, and you will be greeted with tons of messages expressing the users’ frustration with the Stripe billing fees. So what’s with the pricing, you may ask?

Well, Stripe pricing is good. But it can be better.

What is Stripe Billing and How Does it Work?

Before we analyze the Stripe Billing Pricing threadbare, let’s spend a moment to understand what Stripe billing brings to the table.

Stripe billing is a comprehensive billing platform that allows you to bill your customers how you want. From simple recurring subscriptions to sales-negotiated contracts and usage-based billing (not the best use case, though), Stripe can handle it all.

Primarily, Stripe enables you to calculate the amount each user owes and manage their subscriptions. Once this is calculated, a payment is triggered automatically and processed through Stripe payments.

Sounds easy, right? Yes, it is. For most B2C businesses. The actual complexity is when dealing with B2B businesses. And, if you use usage-based pricing, the maze just gets trickier.

And this is where Togai trumps Stripe!

Learn More

But what makes Stripe stand out? Let’s focus our lens on this subject next!

What Makes Stripe, The In-demand Billing Platform?

The Features

Not without reason, Stripe is the most sought-after payment and billing platform. The product certainly has some telling features.

- Costs less than most payment platforms, say Paypal

- Charges nothing for PCI compliance

- Supports the pay-as-you-go model

- Enables easy customization for any business, thanks to the extensive toolset, plugins, and open API access for developers

- Makes it easy to signup and get started

- Comes with a simple and accessible user interface

- Accepts various payment methods

- Enables international business by offering multi-currency support

- Offers high-level encryption that protects against online fraud

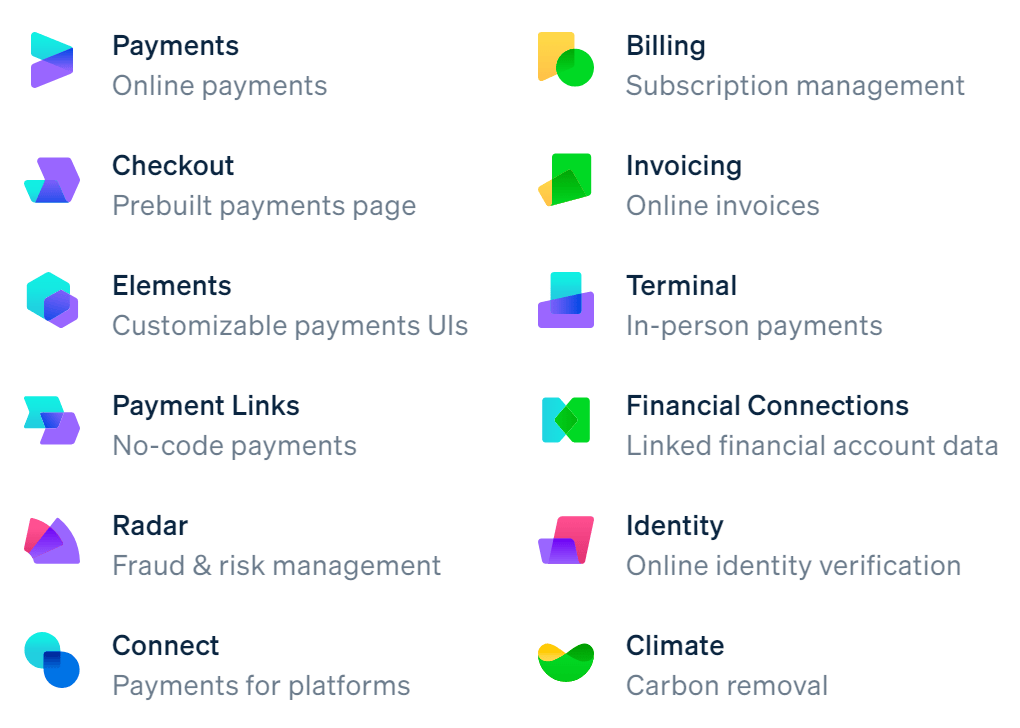

The Integrated Offerings

Stripe allows you to perform end-to-end financial transactions with its suite of integrated offerings:

Stripe Billing - This lets you create recurring subscriptions and invoices. Pricing starts at 2.9% + 30¢for every successful transaction.

Stripe Invoicing - Allows you to invoice upto 25 customers for free every month. Thereafter an overage of 0.4% is applied per invoice paid.

Stripe Tax - Offers you tools for tax calculation priced at 0.5% for each transaction.

Stripe Atlas - Assists you with setting up a company at a one-time setup fee of $500.

Stripe Sigma - Offers reporting and analytics using SQL. Pricing starts at 2¢per transaction and includes a $10 fee towards infrastructure.

All these features and offerings seem too hard to resist, right? But wait till we uncover its pricing structure. You will see a different story, with twists and turns that can keep you guessing.

Stripe Billing Pricing - What Can Possibly Go Wrong?

In a simple market survey, more than a dozen SaaS business owners were asked:

“How much do you pay for Stripe?” There was a mixed bag of answers ranging from 4% to 8% of their total review. But none of them had an accurate figure in mind.

Stripe is one of the most popular payment platforms, and their pricing (normally associated with card processing charges) is generally perceived as transparent - echoing their tagline, “Always know what you’ll pay.”

Doesn’t seem so from the market survey observations, right?

Let us see why.

Limitations with Stripe Billing Plans

Stripe is no doubt a great platform, but it is not without limitations.

Stripe is not designed for B2B.

Stripe was originally designed for e-commerce and B2C businesses only. No. This is not an offset. However, this is a limitation when you try to fit your B2B operations or pricing structures within its existing framework.

Stripe's ecosystem is limiting.

Stripe has a whole suite of integrated products.

But, most of its products work great…well, with only its own products.

Imagine you are using Stripe billing to manage your product subscriptions but would want to handle your payments via PayPal, for example. You can’t do this. You are left only with two options

- Use Stripe Payments - this limits your expansion goals.

- Choose a billing platform that integrates with Stripe Payments.

If you think this isn’t a big deal and go for Option 1, remember, your Stripe fees can escalate as soon as you add more of Stripe’s products into your stack.

Let us illustrate this with an example:

Assume you are a B2B SaaS firm with a regular three-tier subscription offering. Below is a list of Stripe products you will have to bring to support your business model:

| Stripe product | Purpose | Additional costs |

|---|---|---|

| Stripe billing | To handle your subscription, upgrades, downgrades, etc. | If you choose the Stripe Billing Scale plan, you incur 0.8% of your revenue. |

| Stripe checkout | A custom page that allows your customers to select the payment method | Normally included in the Stripe payments, but if you choose to have your own domain, you will incur an additional $10 per month. |

| Stripe payment | For processing your payments |

|

| Stripe tax | Collecting the required taxes and reporting | 0.5% for every transaction |

| Stripe data pipeline | If you would like to extract Stripe data into your own data warehouse | $0.03 for every transaction |

| Total Costs |

|

Of course, some of the other products you may need, say the Stripe quote or Stripe invoicing, may be included in the Stripe payments or Stripe billing solution.

So, think now. Are you ready to leave so much to Stripe?

Scaling up costs you more.

Stripe’s flat-rate pricing of “2.9% + 30 cents” might appear lucrative initially. But as you scale up and your transaction volume grows, Stripe fees can break the bank for you. In fact, you can find better deals with other providers.

Here’s a quick illustration of how your fees will work out if you scale from, say, 1,000 users to 50,000 users.

| Subscribers | Stripe Fees | Total Monthly Fee + 0.8% Revenue |

|---|---|---|

| 1,000 | $630 | $630 + $160 |

| 50,000 | $31,500 | $31,500 + $12,000 |

Also Read - Stripe Billing: Pros, Cons and Alternatives in 2023

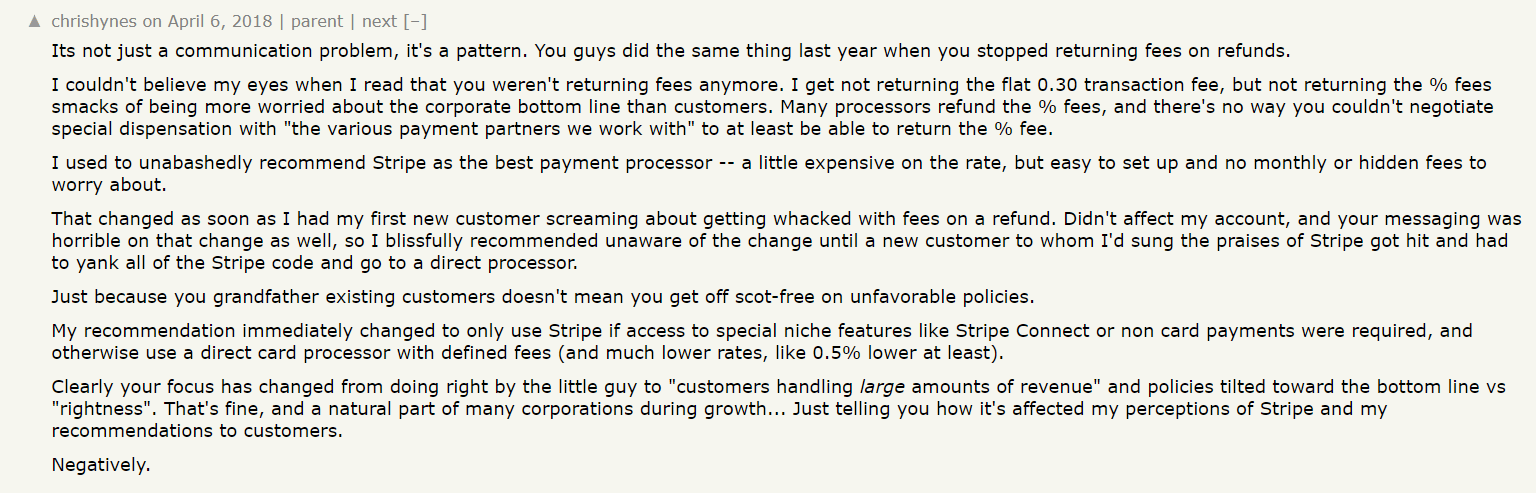

Hidden costs can surprise you.

Stripe pricing is transparent. Or so we believed. Did you know that there are several processing fees that many are not even aware of?

- For international transactions, Stripe levies additional charges for currency conversion!

- During payment disputes, when a customer fails to recognize a transaction, Stripe dumps you with a chargeback fee.

- For refund transactions, Stripe won’t return your original fee. You just have to forego your processing fee on the original transaction.

Check out this specific conversation on the Hacker News thread. You will know what we mean.

Negotiating fees can get hard.

The more you use Stripe’s suite of products, the more difficult it will be to negotiate on the fees. And if you do try to negotiate your prices, remember, the process is pretty complex, and you also get locked into multi-year contractual commitments.

To sum up, Stripe is undoubtedly a great platform. However, the closed ecosystem business model is not agreeable to many businesses. In fact, more businesses are trying to decouple their relationship with Stripe and looking for agnostic billing solutions.

And this is why we built Togai - the world’s easiest metering, pricing, and billing infrastructure. Any pricing model, any industry, any use case.

Learn More

Most companies use two or more software to design a comprehensive billing framework. What if we tell you that you can really minimize the number of software and the associated costs? There are off-the-shelf products that may fit your needs like a glove. But how do you determine which solution suits your needs? Let’s understand.

How to Choose the Perfect Billing Solution?

The best place to begin is to meticulously assess your current needs and estimate your future needs. Before you sign up for a billing platform, remember to ask these questions:

- What different aspects of billing are included?

- Does every offering satisfy your current needs?

- Is there room to scale up and grow?

- What features do you get for the price you pay? Are there additional fees for add-ons?

- How easy/difficult to integrate the product with your internal systems?

The answers will help you decide if the product is the right fit for you. In essence, an effective subscription billing solution should:

- Offer subscription management

- Include payment gateways

- Support different payment methods

- Enable customer communication

- Facilitate the dunning process

- Provide simple reporting features

Also Read - The Best Billing Software for Small Businesses and Freelancers in 2023

Ready to Move Away from Stripe?

Now that we have deconstructed Stripe billing pricing let’s deal with the 800-pound Gorilla. Are you overpaying for Stripe? The answer is both a Yes and a No. Because it really depends on the scale of your business, the product you offer, your pricing model, your business needs, and finally, what you expect from your payment processing platform.

If the Stripe features are something that you cannot live without, you may find the pricing justified. But for many small businesses with tight budgets, the costs may add up significantly.

Stripe may be the dominant player, but Togai is the star player, custom-built for SaaS businesses. Schedule a demo today, and see for yourself how Togai can enable your SaaS billing.

Frequently Asked Questions

What does Stripe billing cost?

Stripe billing pricing depends on the total number of transactions you process and the features you use. The basic plan works out at 2.9% + 30 cents for every transaction processed.

What are the different Stripe billing plans?

There are two plans - Starter and Scale.

- Starter - 0.5% on recurring payments

- Scale - 0.8% on recurring payments and one-time invoicing

How do I know if I am overpaying for Stripe?

Consider the below factors in deciding if your Stripe costs are justified:

- Your monthly transaction volume

- The average invoice amount

- The features you use.

How can I save on my Stripe billing pricing?

Here are a few ways to save on your Stripe billing costs:

- Negotiate a custom pricing plan with Stripe

- Automate your billing workflow in-house

- Partner with a comprehensive billing solution - Think Togai!